mississippi state income tax 2021

27 7 5 and 27 7 18. The personal income tax which has a top rate of.

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

0 percent on income up to 3000.

. Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 Income Tax Regulations Title 35 Part III Mississippi. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4. Mississippi Income Tax Forms.

In Mississippi the 4 percent bracket applies to workers earning approximately 13300already a very large portion of the labor force. Renew Your Driver License. Married - Filing Separate Returns 12000 Spouse SSN City ZipCounty Code Taxpayer First NameSSN.

Senate Bill 2858 2016 Legislative Session Miss. The Mississippi state government collects several types of taxes. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date.

Printable Mississippi state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. A downloadable PDF list of all available Individual Income Tax Forms.

The list below details the localities in Mississippi with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Beginning with tax year 2021. Details on how to.

Mississippi Resident Individual Income Tax Return 801052181000 2021. Ad File 1040ez Free today for a faster refund. Income and sales tax rates Sean Jackson 11122021.

Ad Free tax support and direct deposit. Beginning with tax year 2018 the 3. 2021 Mississippi State Sales Tax Rates.

71-661 Installment Agreement. Mississippi State Income Tax Forms for Tax Year 2021 Jan. If youre married filing taxes jointly theres a tax rate of 3 from 4000.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Additionally the 4 percent bracket. The Mississippi income tax rate for tax.

Detailed Mississippi state income tax rates and brackets are available on this page. E-FIle Directly to Mississippi for only 1499. Department of Revenue - State Tax Forms.

The bill would immediately eliminate the personal income tax for individuals making under 50000 a year and for married couples making less than 100000. The most significant are its income and sales taxes. The thresholds break down like this.

Ad e-File Free Directly to the IRS. 80-100 Individual Income Tax Instructions. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately.

80-106 IndividualFiduciary Income Tax Voucher REPLACES THE 80-300 80-180 80. Mississippi has a graduated. 80-105 Resident Return.

You might have to file a state income tax return. Mississippi Income Tax Rate 2020 - 2021. Mississippi state taxes 2021.

Mississippi taxes income at rates of 0 percent 3 percent 4 percent and 5 percent as of 2021. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Mississippi Tax Rate H R Block

State Income Tax Rates And Brackets 2022 Tax Foundation

States With Highest And Lowest Sales Tax Rates

Tax Rates Exemptions Deductions Dor

States That Don T Tax Social Security

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Which States Pay The Most Federal Taxes Moneyrates

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Income Tax Rates Highest Lowest 2021 Changes

The Most And Least Tax Friendly Us States

Mississippi Sales Tax Small Business Guide Truic

Historical Mississippi Tax Policy Information Ballotpedia

Tax Rates Exemptions Deductions Dor

Mississippi Tax Rate H R Block

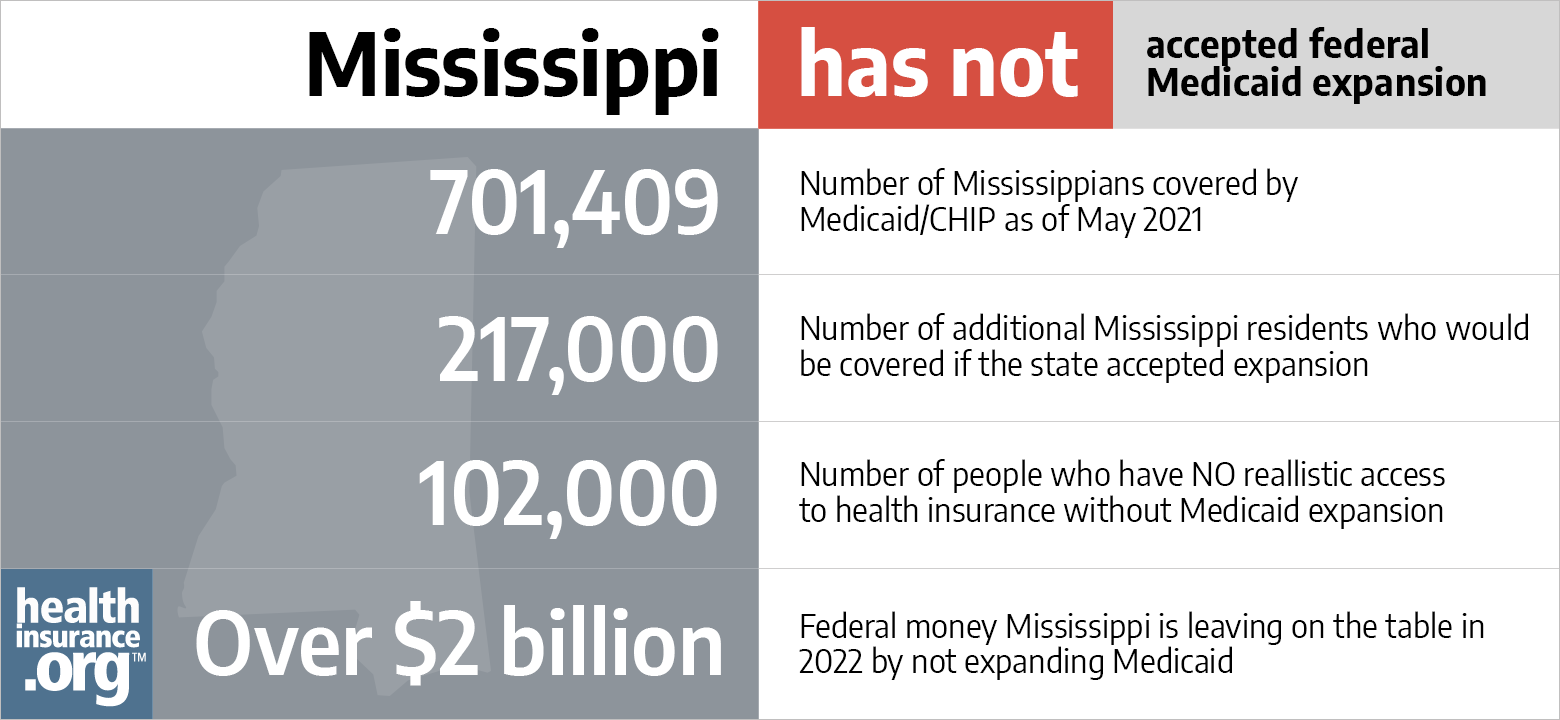

Aca Medicaid Expansion In Mississippi Updated 2022 Guide Healthinsurance Org

Prepare Your 2021 2022 Mississippi State Taxes Online Now

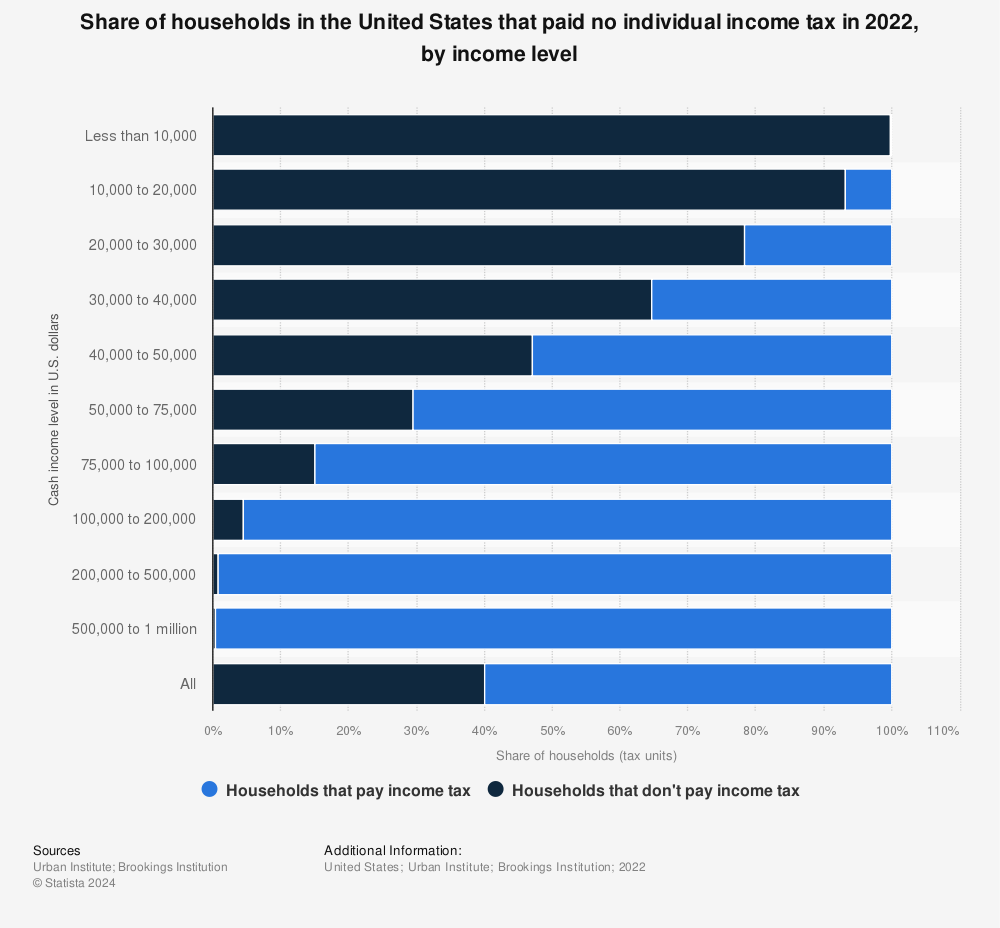

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista